32+ payroll tax calculator oklahoma

Web Web The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. No more surprise fees from other payroll providers.

Oklahoma Salary Calculator 2023 Icalculator

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Well do the math for youall you need to. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems.

The Oklahoma bonus tax percent. Verify Your Eligibility Today. Ad Compare This Years Top 5 Free Payroll Software.

This free easy to use payroll calculator will calculate your take home pay. So the tax year 2022 will start from July 01 2021 to June 30 2022. Tax rates range from.

Web The state income tax rate in Oklahoma is progressive and ranges from 025 to 475 while federal income tax rates range from 10 to 37 depending on your income. Supports hourly salary income and. Web Oklahoma Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

EzPaycheck Calculate Tax Print check W2 W3 940 941 Free Trial. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Oklahoma. All-In-One Payroll Solutions Designed To Help Your Company Grow.

Businesses Can Receive Up to 26k Per Eligible Employee. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Oklahoma Income Tax Calculator 2022-2023 If you make 70000 a year living in Oklahoma you will be taxed 10955.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. All Services Backed by Tax Guarantee. Your average tax rate is 1167 and your marginal.

Get 3 Months Free Payroll. Make The Switch To ADP. Web Oklahoma Paycheck Calculator.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Ad Get full-service payroll automatic tax calculations and compliance help with Gusto. Ad Fast Easy Affordable Small Business Payroll By ADP.

Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. Web Oklahoma tax year starts from July 01 the year before to June 30 the current year. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Free Unbiased Reviews Top Picks. Web The Oklahoma Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Simply enter their federal and state W-4.

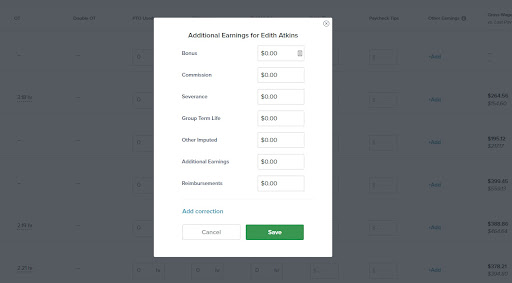

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Oklahoma. Web The calculator helps you determine the recommended withholding allowance and additional withholding if any you should report on your W-4 form. Web This Oklahoma bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Salary Paycheck Calculator Oklahoma Paycheck Calculator Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Get honest pricing with Gusto. Web Oklahoma State Payroll Taxes for 2023 With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive.

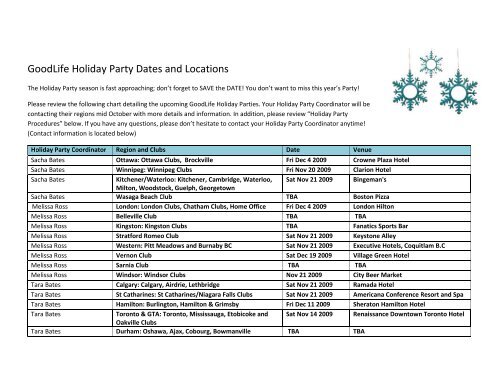

View Print All Articles Goodlife Fitness

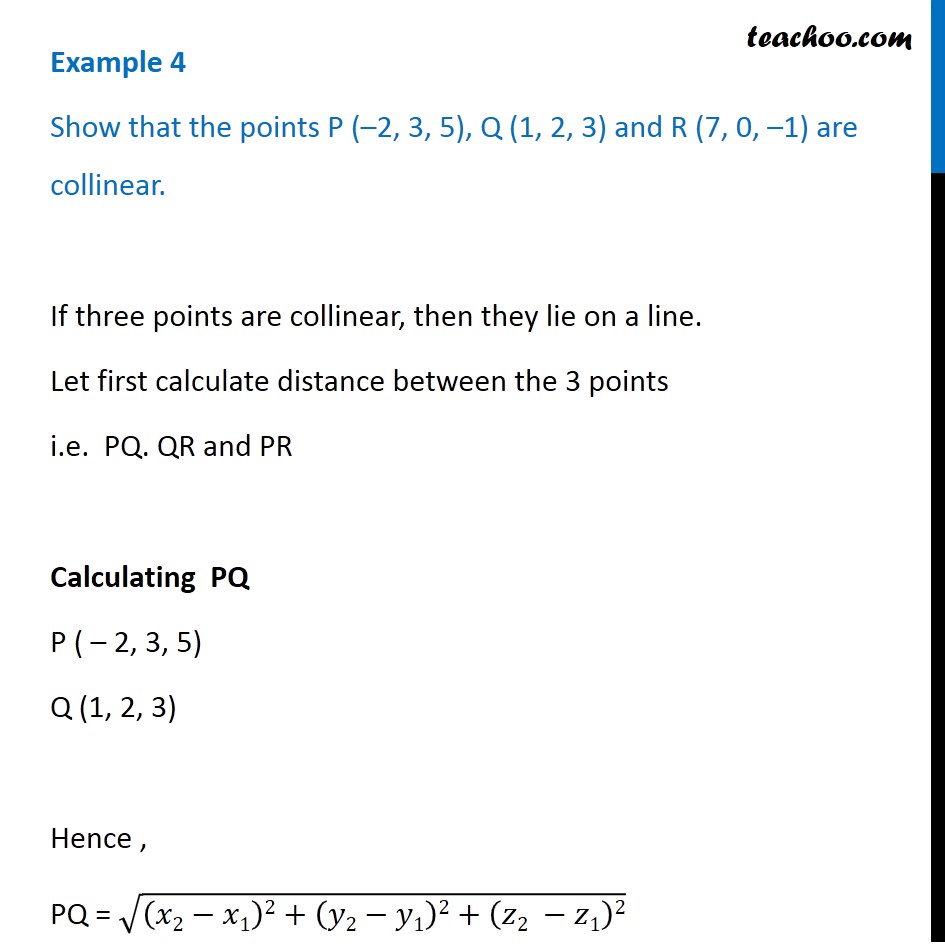

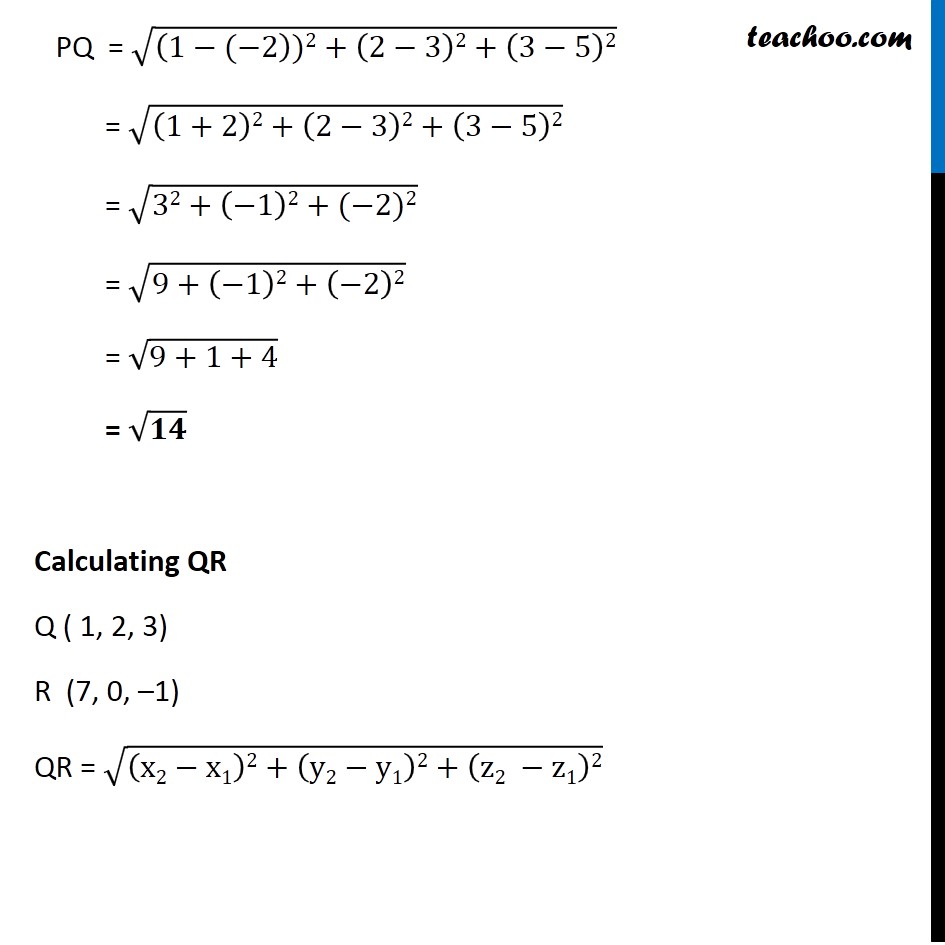

Example 4 Show That Points P 2 3 5 Q 1 2 3 And R

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

How To Calculate Payroll Taxes Wrapbook

Pdf Policy Brief The Case For Electric Building Scale And Speed For Zero Emissions Mobility

H Code Responsive Multipurpose Wordpress Theme By Themezaa Themeforest

Example 4 Show That Points P 2 3 5 Q 1 2 3 And R 7 0 1

Abstract Book 9th European Academy Of Forensic Science Conference By Nfc Polismyndigheten Issuu

Oklahoma Paycheck Calculator Smartasset

Should I File A Income Tax Return For My Internship Salary Which Was 22000pm For Six Months Quora

Free Income Tax Filing Portal In India Eztax

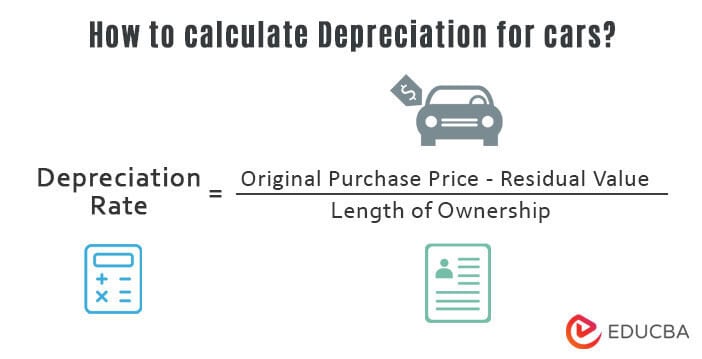

Depreciation For Cars Meaning Rates Formula Examples

Best Prestashop Modules For Prestashop 1 7 1 6 Prestashop 1 7 Modules

What Is Gst Types Rates Calculation Registration Examples

Class Of 2013 University Applications Handbook Uwc Maastricht

Contrails 166 By Gary Ferguson Issuu

New Tax Law Take Home Pay Calculator For 75 000 Salary